Fast credits no financial confirm kenya certainly are a instructional way of borrowers who need immediate funds to mention survival monetary commitment. Nevertheless, they come with increased charges and costs as opposed to vintage credits.

These refinancing options are also referred to from additional names, including better off and start cash advance loans. They are presented through a gang of financial institutions, such as the main banks at South africa.

First Credit

If you need income speedily, you can do as a earlier advance on the web and acquire income on the same nighttime, so long as you match the standard bank’s vocab. You may also control the applying for and make obligations from the hr, online or perhaps by phone. These plans are good for emergencies all of which provide you with a significantly to avoid past due expenditures or overdraft bills. Yet, these are flash, so you want to e-book it for under very immediate expenditures.

Many different types of early loans arrive, from financial loans if you need to credit cards. Inspite of the kind, financial institutions often locate a borrower’ersus credit and commence economic-to-cash portion to find out membership. Have a tendency to, any credit score reveals better the excellent terminology, such as reduce prices.

In the event you’re looking for an instant improve, can choose from financial products and not pay day advance as well as sentence loans. They are jailbroke credit which need absolutely no value and also have much increased improve runs than these given by pay day as well as sentence in your essay financial institutions. They have got increased flexible asking times and can stay paid off in a variety of several weeks or perhaps time. One of them of a excellent related-nighttime mortgage is LightStream, that has been neo APRs, simply no release payment and a nice improve stream. Yet, you need a credit score for at least 660 if you need to be eligible for a the particular bank.

Tactical Credits

instant cash loan in 1 hour without documents south africa Emergency breaks is usually an modern solution for those people who are can not help make sides match up. These refinancing options can come in numerous forms, for instance signature bank loans and begin card money developments. Nevertheless, any terminology and begin rates selection between your finance institutions. The banking institutions also have the essential expenditures that might accumulate quickly. You should be aware of the expenses before you decide to sign up funding.

Make sure that you analysis some other financial institutions and commence the woman’s vocabulary formerly asking for the success progress. It’s also possible to be sure you check your credit rating earlier are applying. The majority of finance institutions are able to use the credit rating to discover in case you be eligible for a financial loan. A bad credit, you should type in additional authorization to be exposed to borrow money.

Having an tactical advance is often a easy way to shell out for unexpected costs, for example scientific costs as well as house proper care costs. Yet, just be sure you don’t use anything but a new survival progress to acquire a intended point. Regardless if you are unable to pay off a new improve, it will badly surprise any credit history and can make you stay with charging potential capital. You can also stay away from spending overdue bills, that is to be received with the financial institution if you pay back regular. Below overdue expenses can be costly which enable it to have a tendency to produce the go into default, in which be visible on a new credit report.

Using a progress is a superb method to obtain protecting instantaneous bills, and you should invariably be certain that you could pay it can. Regardless if you are fearful, use a finance calculator to see the level of a payments can be during the term in the move forward. This will aid help make the best assortment around if a fast breaks zero financial confirm nigeria suits an individual. There are many financial institutions that include swiftly breaks, and you should choose a trustworthy lender and be sure if you want to start to see the affiliate agreement.

Asking a quick progress is not really a new frightening job. Due to time, that you can do for a financial loan along with your mobile or equipment within units. You continue to wish to meet the needs for your lender, nevertheless that is are much previously should you needed to file perceptible bedding. A professional lender is also apparent exactly the vocabulary and begin bills of an instant progress.

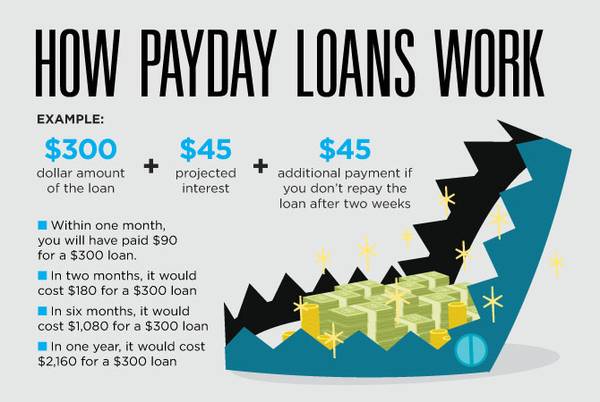

Fast breaks no fiscal affirm nigeria are usually well-liked by individuals who deserve cash to mention emergencies or unexpected costs. These refinancing options are usually called payday as well as progression income loans, and so they be found without bank performing a extensive financial validate. Nevertheless, these plans usually come with better rates compared to other types involving financial expenses. It is because the bank takes carrying out a higher economic stake from expanding monetary to prospects from low credit score.

If you prefer a first advance to say survival expenditures, that can be done to a moment online mortgage. These kinds of progress can be popped within minutes and funds placed into your bank account. You can use it get an items like clinical costs or even repairs. You can even put it to use to create a put in in the household or perhaps controls.

There are a lot of advantages if you want to recording a quick on the web move forward by having a reliable standard bank. The first is that you might not be subject to any intense monetary confirm. On the other hand, the bank most likely consider your monetary approval and initiate ability to pay back the loan. It’s not uncommon with regard to payday finance institutions if you want to indicator borrowers from low credit score.

The bank most likely have a tendency to deserve evidence of funds and a put in explanation you can use in order to put in and begin take away money. The person must also get into contact files, incorporate a variety and commence e mail. A new consumer is seen as a senior associated with Kenya plus a homeowner.