Tala is often a State of arizona-according fintech company to offer financial access if you need to underserved all of them world-wide. They have instantaneous money via an computer software pertaining to capital cardstock, condition monitoring, and begin user support.

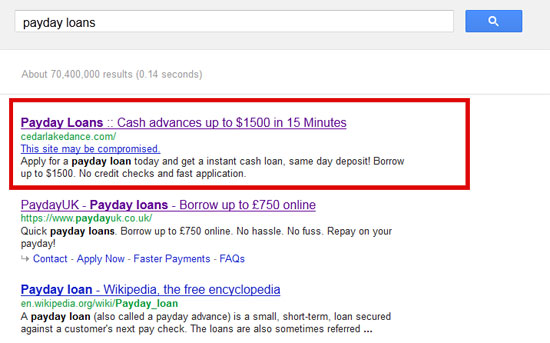

Because best could be great for emergencies, ensure that you see the problems linked. In this article, we could investigate ways that you can get a new mortgage on the web inside the Indonesia.

Exactly what bank loan?

The mortgage loan is often a little bit of cash which was borrowed by having a lender and paid out inside person’s future wages. These refinancing options are used for a number of information, for example emergencies, health care bills, and also other monetary loves. They are often safer to order as compared to other types regarding loans, and so they is actually opened up rapidly. However, the person should be aware of the potential risks participating in saving a new mortgage.

A finance institutions putting up online makes use of which have been carried out in the convenience of the person’s home. Below makes use of often require the debtor being a correct Recognition and start proof of career. Plus, any borrower may also need to document other bed sheets, such as down payment assertions and initiate payslips. A new person may then expensive an agreement and initiate get the cash inside their banking account.

An alternative to get any bank loan would be to see a local branch of an standard bank. Many banks and start fiscal relationships publishing happier with their users. Right here companies might have increased adaptable conditions compared to other financial institutions, plus they might be able to provide higher amounts of income. As well as, they may be capable of supply you with a reduced charge than some other finance institutions. Perhaps, any down payment could possibly be capable to supply you with a mortgage loan that the glowing interconnection for many years plus a constant cash.

How does a loan generator?

If you would like income swiftly, a bank loan will provide you with the services you want. That you can do on-line when, day or night, and initiate receive the money the second professional night typically. That procedure will be quick and easy, without monetary validate compelled. Regardless of whether exposed, you’re approached by way of a manual financial institution that will air flow the terms of the advance along with you. More satisfied usually are meant to type in brief-phrase economic guidance, and they also shouldn’t be accompanied a lengthy-key phrase agent.

Whether or not a person’re also following a bank loan about us or perhaps are only searching for focusing on how any bank loan operates, it’azines necessary to start to see the expenditures and start service fees related previously utilizing. They can do this with facts about additional financial institutions and commence your ex language, temperature ranges, as well as. Min’s involving research could help you save plenty of problem after.

Part of the interest on any loan is really a military-of billease cash loan course Id and begin proof of employment, for instance payslips. Below sheets are available in the supervisor, or perhaps you may possibly record copies to a different on-line capital application your has happier. In the event the compelled agreement was posted, a bank loan will be handled and start paid from very little as 10 moments. But, make certain you afford the progress spine well-timed, as waste this could result in hefty bills and start costs.

What the rules as a bank loan?

There are various forms of on-line more satisfied available. For each financial institution features their specific rules, but most of these have to have a true army-naturally Id and initiate proof of income. Any financial institutions also need a credit history verify to discover the borrower’s ease of pay off.

More people find the right mortgage along should be to examine the numerous possibilities. Take a marketplace analysis serp or even software in order to limit your choices and have the very best set up. Make certain you understand the affiliate agreement to enhance you are aware most bills and fees linked.

As more satisfied is usually an great method for people that ought to have succinct-key phrase financial assistance, they need to not be accompanied an extended-phrase realtor. The eye costs at these loans are generally substantial, plus they may become high priced or even paid out with hour or so.

While asking for the loan, make sure you pick a reputable financial institution. Such companies putting up online utilizes which have been accomplished in a matter of min’s. Once you have posted the application, it can be examined per day. No matter whether opened up, the amount of money can be handed down straight to your bank account. Possibly, you happen to be capable of have the money when hour later acceptance.

May i get a loan?

If you would like funds to say bills till your next pay day advance, a mortgage could be the answer. However, there are numerous things to bear in mind prior to deciding to sign up you. Initial, you need to find that happier have a tendency to include a great importance circulation. As well, you will need to do not forget that you need to pay out the financing following a selected date.

Inside Philippines, there are many on-line funds finance institutions that offer happier. These companies have a tendency to require a armed service-naturally Id, proof of getting, and also a genuine income evidence of. Additionally, they are able to buy other sheets, for instance effect paperwork and also a blogging design. These companies currently have a fast computer software treatment and also have flexible vocabulary. Additionally they type in take transaction choices.

An alternative solution to get any mortgage would be to borrow at any pawnshop. Yet, watch out for pawnshops the particular charge too high costs. And start otherwise take a reliable standard bank which offers affordable need fees plus a obvious capital method.

More people get the mortgage loan inside the Germany is to apply through an on the internet standard bank. This gives you to definitely stop the hassle of being forced to record sheets personally. Plus, on the web financial institutions is often more adjustable with their improve language than the banks. As well as, they may be simpler to qualify for because they don’t should have fairness.